The overall Chinese market returned to negative numbers in June, down 6% year over year (YoY), but on paper, plugins fared much worse, down 53% last month.

But this number is misleading, because last month°Įs result, with over 91,000 units, was in fact this market°Įs second best result in the last 12 months, while June 2019 marked an all-time high for plugins in China, due to a sales rush derived from the subsidies changes that happened at the time.

With this in mind, expect next month to see a return to growth, as July 2019 was the first month with the current subsidy rules.

June was the best selling month this year, and that shows in June°Įs plugin share, which was 5.5% (4.1% BEV/fully electric vehicles). This pulls up the 2020 share by 0.4%, to 4.7% (3.6% BEV), which is still below the 5.5% of 2019, but is a step in the right direction. Hopefully the second half of the year will bring the possibility to at least reach last year°Įs score, maybe better.

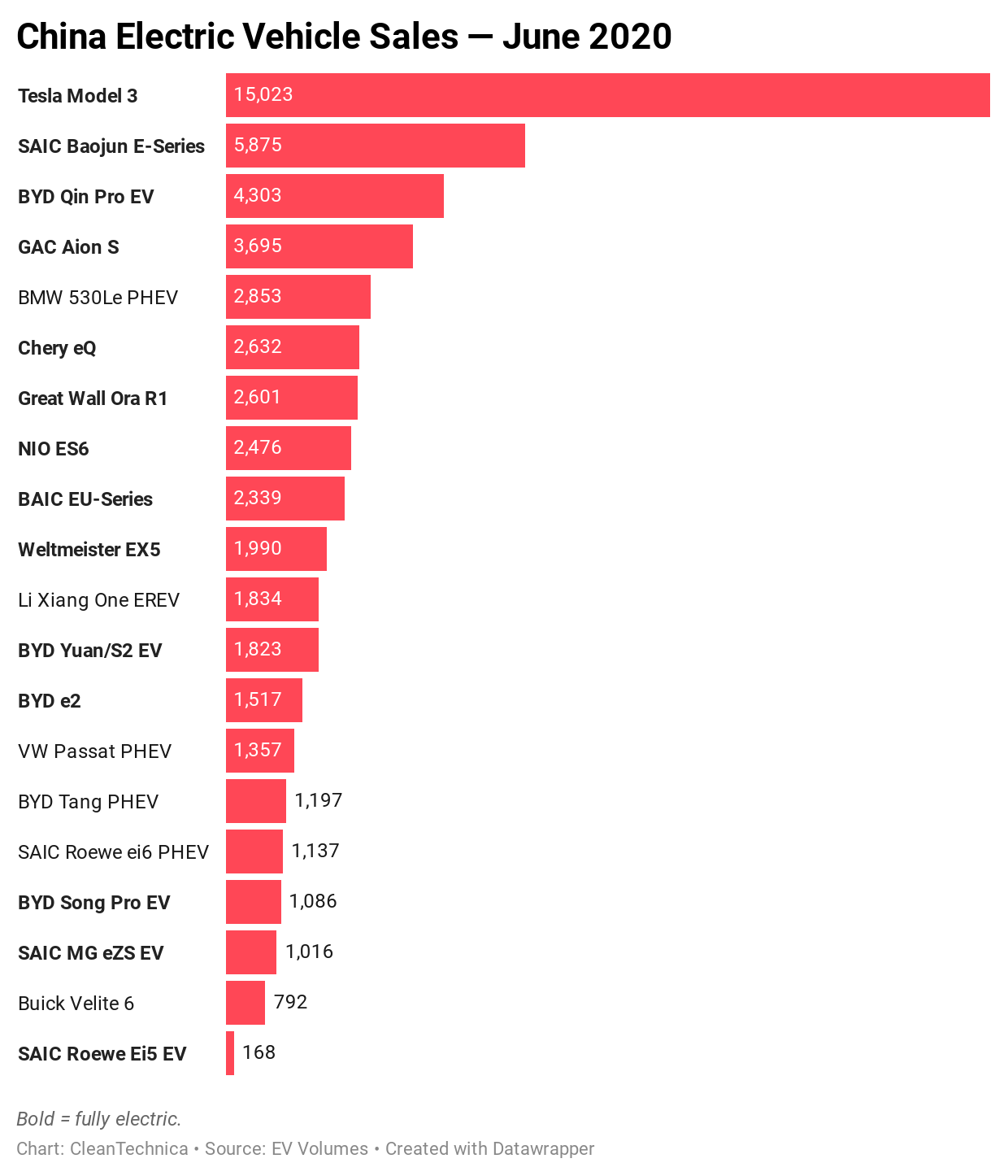

Looking at June best sellers, the Tesla Model 3 dominated the scene, almost tripling the deliveries of the surprise runner-up, the Baojun E-Series, highlighting the most recent trend in this market °™ the return of city EVs, underlined by the small Chery eQ and Great Wall ORA R1, which were were #6 and #7, respectively, in June.

#1 ®C Tesla Model 3

The poster child for electric mobility hit a record 15,023 units (including estimated imports), and while it°Įs still not an all-time high for EVs in China (that is still in the hands of the BAIC EU-Series °™ 21,963 units last December), Tesla°Įs midsizer is getting closer to it. And the Model 3 is starting to get in the way of the category°Įs best sellers in the overall market, as the Californian was #23 overall in June, ahead of the #24 BMW 3 Series and not that far off from the #21 Mercedes C-Class. So, the Tesla sports sedan still has some room to grow. Will we see it reach some 20,000 units/month cruising speed this year? Intriguingly, in Q2, the Model 3 started slow (4,312 units in April), then picked up the pace in May (11,468), and ended the quarter with a bang, with 15,023 units registered, replicating Tesla°Įs typical behavior elsewhere. A coincidence, or is Tesla China also addicted to end-of-quarter peak deliveries?

#2 ®C SAIC Baojun E-Series

With the end of subsidies for most of the small city EVs, ones unable to reach the minimum qualifying range of 250 km, Baojun won the lottery last year, thanks to its E-Series (E100/200/300) lineup of city EVs. The Shanghai Auto and General Motors offspring has been watching its sales jump in the past few months, winning a #2 spot in June thanks to 5,875 units last month, a new year best. Access to the current subsidy, added to competitive pricing before subsidies (CNY 93,900 / USD 14,700), makes it an appealing model for carsharing companies, as well as other kinds of fleets.

#3 ®C BYD Qin Pro EV

The automaker°Įs response to the GAC Aion S and Xpeng P7 reached 4,303 units in June, so BYD°Įs bet on its electric sedan staying among the podium°Įs best sellers is working, but demand could end up being an issue soon, not only because of the ever increasing competition from other makers, but also because of internal competition from the upcoming Han full size car, an appealing and technologically advanced model that might pull away some buyers from its smaller sibling.

#4 ®C GAC Aion S

GAC°Įs sleek sedan was only 4th in June, having registered 3,695 units (excluding the Toyota-badged iA5 units). This was an unexpected drop compared to the previous month, which might be linked to the arrival of its SUV sibling, the Aion V. One of the most competitive domestic electric sedans on the market, the Aion S should continue to be a regular in this top 5. It is a strong candidate for a 2020 medal position.

#5 ®C BMW 530Le

The BMW luxury sedan continues to be a hot item in China, impressing in more than one way. First, it°Įs impressive that it has steady demand flow, consistently scoring 2,500+ performances. Second, the full-size sedan is keeping pace in the top positions with cheaper models. Third, despite the wave of new full-size models (Li Xiang One is the most successful of them), both imported and locally-made, the big Bimmer is still the undisputed leader in the luxury category, continuing to sell close to 3,000 units per month, which is well above its direct competitors, which are happy to reach 1,000 units in one month.

Li Xiang ONE

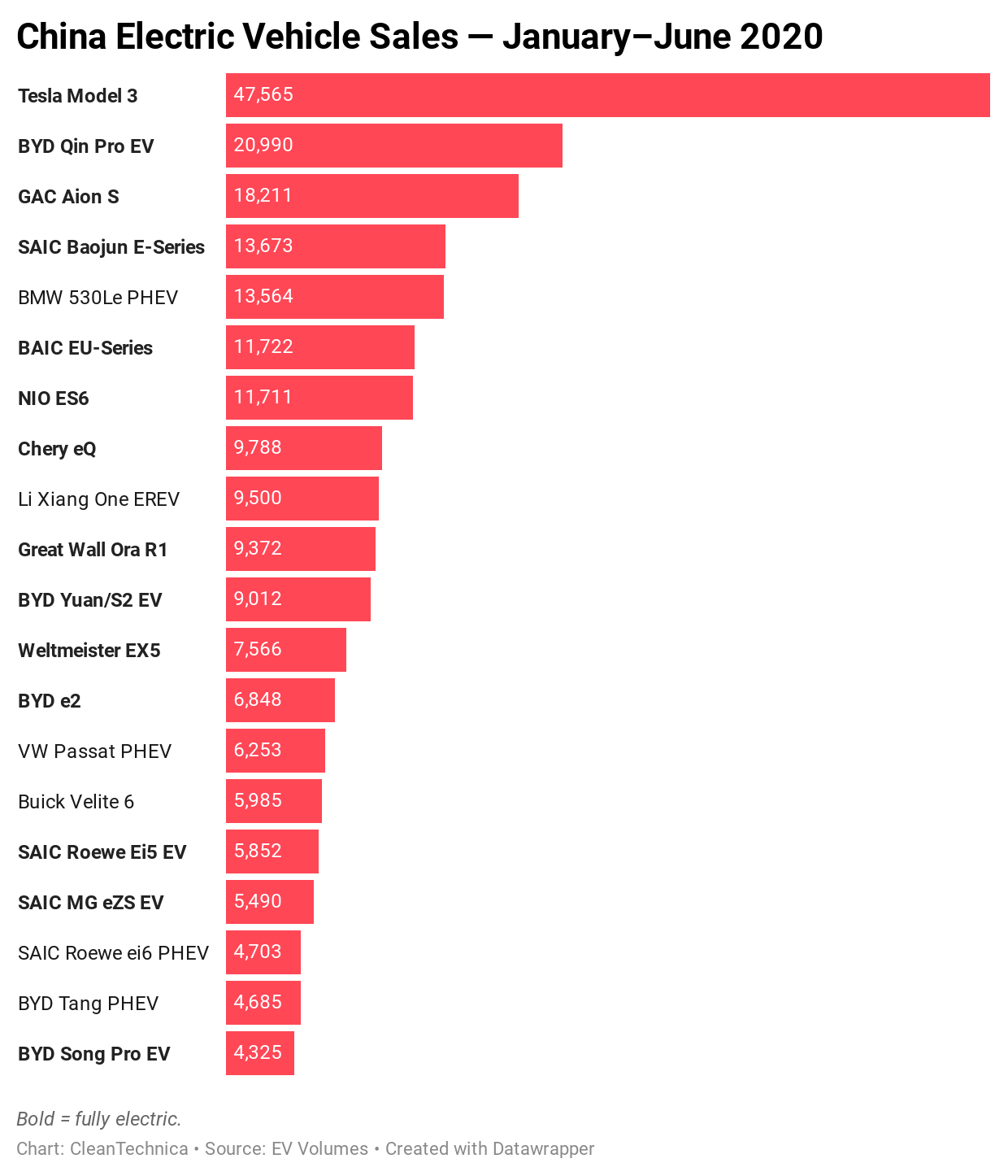

Looking at the 2020 ranking, the top positions remained the same. Tesla already has enough of an advantage to start preparing the celebrations for its first Best Selling Model trophy ceremony. Meanwhile, the Baojun E-Series jumped two spots, to 5th, thanks to 5,875 deliveries, a new year best.

While in recent months the hype was about EV startups, now the mood is changing, with only one startup model climbing in the ranking °™ the Weltmeister EX5 was up to #12, thanks to 1,990 units registered, its best score in the past 10 months.

Now, city EVs are returning to the spotlight °™ not only the Baojun E-Series, but also the Chery eQ climbing to #8 thanks to 2,632 units, its best result in a year. Additionally, the Great Wall Ora R1 (2,601 units, a new year best) was up to #10, now making it 3 small BEVs in the top 10.

BYD had a somewhat positive month, with the e2 compact hatchback climbing one spot, to #13, thanks to 1,517 units, a new year best, while the Shenzhen automaker saw two models joining the table, with the Tang PHEV (1,197 units, its best score since last October) back to the top 20, in #19. The Song Pro EV (1,086 units, a new personal best) is a new face in the ranking, and could climb higher in the next few months.

Other models on the rise are the Roewe ei6 PHEV, climbing to #18, while the locally made VW Passat PHEV jumped to #14, thanks to 1,357 units registered, leading a strong month for the German automaker, which had five (5!) plugin models scoring four-digit results. Besides the aforementioned Passat PHEV, the Tiguan PHEV, the Tayron PHEV compact SUV, the e-Lavida sedan, and the e-Bora sedan all registered over 1,000 units in June.

Below the top 20, a reference goes out to the BYD Song Pro PHEV, which registered a year best score of 1,060 units last month, jumping to #21, making that 6 BYD models in the top 21 positions! The NIO barge flagship SUV, the ES8, scored 1,264 units last month, its best performance since June 2019, mostly due to the new 100 kWh version. And the Honda XN-V EV, basically a made-for-China BEV version of the Honda HR-V, had a record 1,268 unit score last month. Is Honda finally waking up to BEVs?

Looking at the manufacturer ranking, BYD (16%, down 1 point) is still in the leadership position, but slowly losing charge, with Tesla (14%) firmly in 2nd. SAIC (10%) is holding down its spot in 3rd as well. Below the podium, we see a position change, with Volkswagen (7%, up 1 point) climbing to #4, switching positions with GAC (6%, down 1 point). BAIC and BMW, both with 5%, are waiting for a chance to climb higher.

Cool New Kids on the Block Market We have a new member in Geely°Įs Geometry family, the Geometry C, a dedicated BEV with a compact hatchback body, but considering the failure of the first model, the Geometry A sedan, that is selling in the low hundreds per month, one can hardly imagine a better future for the hatchback, as this type of body has less potential than sedans in China. In other news, another model has landed in June with much higher sales expectations, the °≠

GAC Aion V °™ Up until 2018, GAC was far from being considered °įcutting edge°Ī in the new energy vehicle market, with its sales paling next to BYD°Įs, BAIC°Įs, or SAIC°Įs. But then, a new sub-brand, Aion, emerged, and its first model, the sleek °įS°Ī sedan, was a game changer, becoming an instant success and propelling it to #6 in 2019 (and #3 right now, as you can see above).

A few months later, GAC launched Aion°Įs second album model, the LX midsize SUV, which failed to replicate the S°Įs success. The new model also had an appealing style and specs, but the higher price meant that it was a tougher sell to customers. After all, it wasn°Įt from a fancy foreign brand, and it hadn°Įt collected the cult-like adoration of some EV startups.

Now it°Įs time for Aion°Įs difficult 3rd album model. After one hit and one miss, it°Įs time to untie the match with the Aion V compact crossover. Behind the original styling lies once again a competent model, with Huawei 5G connectivity allowing China°Įs first HD map and future L3 autonomous driving, as well as up to 600 km (375 mi) range under the NEDC standard (think some 450 km / 280 mi real-world range). It also has an electric motor with 135 kW (181 hp). Aion°Įs crossover ticks all the right boxes to have success, and this time even the price helps. At some 200,000CNY (25,000Ä or $28,500), it is only 15% more expensive than the S sedan, and a significant 30% cheaper than the midsize LX.

So, how high will the Aion V go? BYD°Įs SUV counterpart to the successful Qin Pro EV, the Song Pro EV, has just joined the top 20, hitting a little over 1,000 units/month, so the minimum for this model to not be considered a failure is the same, meaning 1,000 units/month. However, with direct competitors, like the Weltmeister EX5, going beyond that, I believe that for this 3rd model to be considered a success, it will need to go beyond 2,000 units/month, thus allowing GAC to move on from its current °įone trick pony°Ī status of today.

Speaking of °įone trick ponies,°Ī Tesla should also follow the behavior of this model and the Aion S from now on, because just like the BYD Qin Pro EV / Song Pro EV duo, they could help to determine how the ratio between Model 3 / Model Y will unfold in China. One of the peculiarities of this market is that sedans are still more popular than SUVs/crossovers, and that is proven by just looking at the current top 20, where the best selling SUV is just #7.

Source: CleanTechnica

|